As 30 June nears, small businesses across Australia need to get their financial house in order. At Global Insurance Solutions, we understand that strategic planning around tax deductions can have a major impact on your bottom line. By staying proactive, business owners can enhance their financial health, minimise unnecessary expenses, and allocate funds for growth.

Why Tax Deductions Matter More Than Ever?

With rising operating costs and frequent changes to tax regulations, failing to take advantage of legitimate deductions can lead to financial strain. Many businesses, especially smaller ones, overlook everyday business expenses that may be tax-deductible. From software tools to insurance premiums, knowing what qualifies is the key to maintaining healthy profit margins.

Need tailored advice on protecting your business assets? Speak to our team today.

Commonly Missed Small Business Deductions

Everyday Costs That Add Up

Even small expenses can make a big difference at tax time if you claim them correctly. Some common deductions that many small businesses forget include:

- Home internet and mobile use

If you use your internet or phone for business tasks like sending invoices or calling clients, you can claim a portion of the cost.

- Software and cloud subscriptions

Business tools like accounting software or project management apps are usually tax-deductible.

- Vehicle expenses

If you use your car for business travel—like going to meetings, making deliveries, or visiting suppliers—you can claim the business-use portion.

- Home office expenses

If you work from home, you can claim part of your electricity, internet, office furniture depreciation, and other costs.

Want to streamline claims and manage your insurance efficiently? Visit our Claims Support page for guidance.

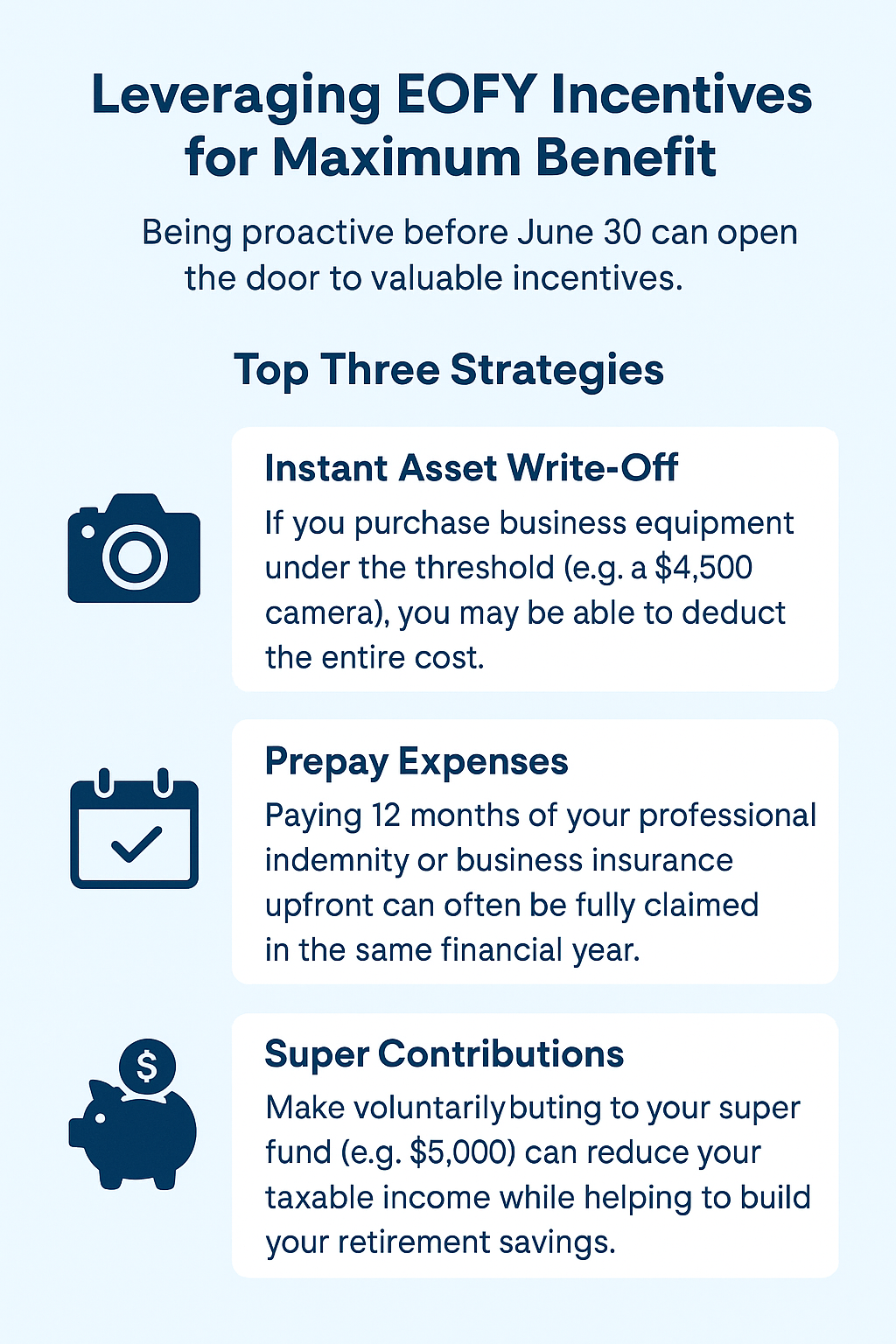

Leveraging EOFY Incentives for Maximum Benefit

Taking proactive steps before 30 June can unlock valuable tax incentives.

Top Three Strategies

1. Instant Asset Write-Off

If you buy business equipment under the threshold (e.g., a $4,500 camera), you may be able to claim the full amount as a tax deduction.

2. Prepay Expenses

Paying 12 months’ worth of your professional indemnity or business insurance premiums in advance can often be claimed in full for the financial year.

3. Super Contributions

Making a voluntary contribution to your super (e.g., $5,000) can reduce your taxable income while growing your retirement savings.

Turning Missed Deductions into Strategic Gains

Avoid the last-minute rush. Instead, apply the following strategies throughout the year:

- Use accounting software to categorise business expenses each month.

- Set reminders for key actions, like scheduling EOFY asset purchases or paying insurance premiums.

- Speak with a tax professional to confirm claims, such as the business-use percentage of your home office.

For complex insurance matters, reach out to Global Insurance Solutions for advice tailored to your business.

Explore More EOFY Business Protection Resources

Looking to strengthen your business risk protection strategy further?

- A Founder’s Guide to Insurance for Tech Startups – Stay protected from coding bugs to cyber breaches.

- Guide to Business Liability Insurance – Understand what liability policies your business may need.

- Strategies for Minimising Income Loss in Rural Petrol Stations – Tips for regional businesses to stay financially resilient.

Award-Winning Support You Can Trust

Global Insurance Solutions was honoured with the Small Brokerage of the Year 2025 award and an Excellence Award by Insurance Business Australia. This recognition reflects our unwavering commitment to protecting Australian businesses through tailored, expert-driven insurance solutions.

Final Checklist: Maximise Your Deductions Before 30 June

Action Points:

- Categorise business expenses each month using accounting software.

- Purchase equipment and pay for services before 30 June.

- Review your insurance policy to check if prepayments are tax-deductible.

- Speak with a registered tax adviser to confirm any complex deductions.

For insurance planning and strategic EOFY support, Get in touch with our team.

FAQs: EOFY Tax Deductions for Small Businesses

1. What are the most commonly missed tax deductions for small businesses?

Many small businesses overlook deductions like home internet use, mobile phone expenses, software subscriptions, home office costs, and vehicle-related travel. These everyday costs can add up when properly documented and claimed.

2. Can I claim my business insurance premiums as a deduction?

Yes. If you prepay 12 months of professional indemnity or business insurance before June 30, you can claim the full amount in the same financial year.

3. What is the Instant Asset Write-Off, and how does it work?

The Instant Asset Write-Off allows eligible businesses to deduct the full cost of an asset (such as office equipment or tools under a certain threshold in the same year it’s purchased and used or installed, rather than depreciating it over time.

4. Are voluntary super contributions tax-deductible?

Yes. If you make voluntary contributions to your superannuation fund (e.g., $5,000) before EOFY, you may be able to claim a tax deduction, which can reduce your taxable income and boost your retirement savings.

5. How can I prepare for EOFY to maximise deductions?

Track expenses monthly, use accounting software, prepay deductible expenses like insurance, and consult a tax adviser to validate complex claims. This proactive approach can help you claim more and reduce financial stress.

6. Can I claim home office expenses even if I only work from home part-time?

Yes. If part of your home is used for business, you may be able to claim a portion of utilities, internet, and depreciation of furniture, based on business usage.

7. Why is it important to act before June 30?

Many deductions and incentives, such as asset write-offs or prepaid expenses, must be completed before EOFY to be claimed in that financial year. Acting early helps you maximise your entitlements and avoid last-minute errors.

8. How can Global Insurance Solutions help with EOFY planning?

We offer tailored advice on insurance strategies, risk protection, and smart prepayment options to help boost your tax efficiency while ensuring comprehensive business coverage.

Important notice

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Global Insurance Solutions Pty Ltd make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Global Insurance Solutions Pty Ltd.

Risk Advisor, Insurance Broker & Director

With around 15 years in insurance, Yuvi Singh is a passionate Risk Advisor, Director, and Insurance Broker at Global Insurance Solutions. Backed by a Commerce degree and ANZIIF diploma, Yuvi leads a team servicing SMEs across industries like manufacturing, logistics, fuel, IT, and more. At GIS, clients benefit from tailored, transparent advice, access to 150+ insurers, and end-to-end risk solutions. Recognised as a 2022 Insurance Magazine Rising Star and 2024 Top Insurance Broker by Insurance Business Australia, Yuvi delivers flexible, effective outcomes with integrity and innovation.